19 January 2023 –

Asset declaration systems are one of the most powerful tools in combating corruption. The effectiveness of asset declarations all depends on their verification. When verifying asset declarations of public officials, access to foreign data is often a challenge. This guest blog by Dr. Tilman Hoppe explores how the “International Treaty on Exchange of Data” finally closes a legal gap and what civil society organisations can do to expand this new tool’s reach. This timely piece of recent research follows Moldova’s signing of the Treaty in October 2023, the fourth country to do so.

1. Most needed: data from abroad

Over the past decades, civil society and international organisations have pushed governments worldwide to have public officials declare their wealth and private interests. As of today, almost all countries have such a system of asset declarations (more than 160 out of 194).[1] In effective systems, integrity bodies check that declarations are complete and truthful, in some countries already with decades of experience.

Inspectors have been working daily in these integrity bodies to check whether a public official is hiding assets as they are usually financed from corrupt sources. This could be a house, boat, bank account, or trust fund. To check for hidden assets, the inspector usually has (online) access to the State’s registers and databases, such as for real estate, vehicles, bank accounts, or taxes. In this regard, the verification is rather easy.

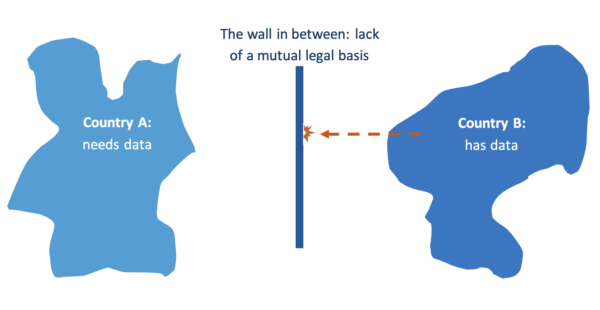

But what happens if the asset is hidden abroad? Even if the inspector can read the language of the foreign real estate cadastre, it is usually not openly available and searchable by name. In this case, the inspector might ask the foreign authorities for the relevant data. However, without a legal basis, they will (and must) not transmit personal data to an inspector of another country. In practice, this is where the check ends. Practitioners, therefore, describe the lack of access to foreign data as the main problem in verifying the asset status of public officials:

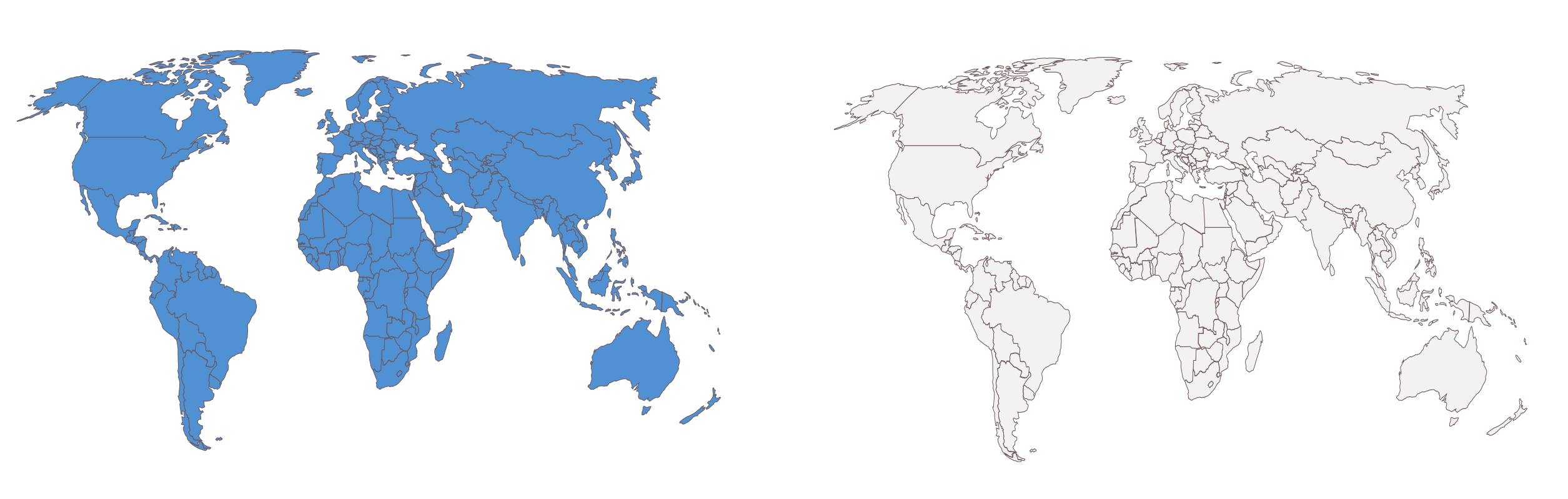

Corrupt public officials are pleased with this status quo: They can hide assets abroad (or invent income from abroad) without great risk of detection. Therefore, one would expect that after decades of anticorruption reforms, and with billions spent by donors, the Council of Europe, EU, OECD, or UN would have addressed this central challenge. Surprisingly they have not, and for no good reason: In the area of taxes all (!) countries of this world have a mechanism for exchanging data cross-border for tax matters. Astonishingly by contrast, in the area of asset declarations, the number is zero:

| Countries with a data exchange mechanism in tax matters (marked in blue): > 190 |

Countries with an exchange mechanism for asset declarations |

2. Data protection: legal basis necessary

The need for a legal basis for cross-border exchange of personal data stems from the right to privacy as enshrined in Article 12 of the Universal Declaration of Human Rights and Article 8 of the European Convention for Human Rights (ECHR). Transferring personal data to another country significantly interferes with this human right. The European Court of Human Rights (ECtHR) underlined that such a transfer “must have a basis in domestic law and be compatible with the rule of law […]. The law must thus be adequately accessible and foreseeable […].”[2] The Court found that a transfer of banking data from Switzerland to the United States tax authorities was in line with Article 8 ECHR, as the bilateral agreement and protocol it was based on “were negotiated and concluded by the [Swiss] Federal Council, approved by the Federal Parliament and then ratified by the Government”.[3]

3. No legal basis so far

3.1 Anticorruption laws

In some rare cases, domestic anticorruption laws contain some vague clauses allowing integrity bodies to cooperate with foreign counterparts, conclude bilateral agreements, or request data. E.g., Article 46 para. 4 and 5 of Law 7/2020, Timor Leste states: “The relevant authority can appeal for international cooperation to obtain information from foreign banks, legal persons, and governments if the assets are out of the country”. The Ukrainian Corruption Prevention Law states in Article 72 para. 1: “Competent authorities of Ukraine can provide the relevant foreign authorities with information and get information from them, including that with restricted access, concerning questions of prevention and combating corruption in compliance with the requirements of the legislation and international treaties of Ukraine, approved by the Verkhovna Rada of Ukraine.” While legislation in Timor Leste only empowers the request for data, the Ukrainian legislation also addresses the provision of data; however, only to the extent legislation or ratified international treaties foresee it. In verifying asset declarations, this is not the case for Ukraine.

Even if provisions would exist, that provide a concrete basis for data exchange on verifying asset declarations, they would have to fit each other: The legislation in country A must empower its integrity authority to request and use the data, and the legislation in country B must empower its integrity authority to provide the data. In addition, the conditions for the transfer in both legislations need to match each other sufficiently (unlike the above example of Timor-Leste and Ukraine). As far as can be seen, this is not the case anywhere until today.

3.2 International treaties

3.2.1 Criminal matters

There are international treaties on mutual legal assistance in criminal matters allowing cross-border data exchange in criminal matters. However, to apply them, one needs a “criminal matter”.[4] Verifying an asset declaration is not a criminal investigation. There might be no suspicion (yet). Like a tax audit, the purpose of the check is in most cases to ensure general compliance. Therefore, in taxes, mechanisms had to be created for the data exchange between tax authorities.

3.2.2 Taxes

To apply international treaties on cross-border data exchange in the area of taxes, one needs a “tax matter”.[5] Firstly, this means that the authority verifying the asset declaration in country A must establish that an undeclared item is related to taxation (e.g., tax evasion). But – why should, for example, owning a vacation home abroad be a tax matter? Property taxes, if any, are due to the foreign state; no income is generated (only costs). Therefore, the authority verifying the asset declaration in country A will already have difficulties in convincing the tax authority of country A to recognise the case as a “tax matter” and to request the relevant data from the tax authority of country B. Secondly, the authority verifying asset declarations in country A would have to convince its tax authority to share the data. This might even be unlawful as the purpose of transmitting the data is limited to tax matters.

These legal and organisational obstacles are difficult, if not impossible to overcome. No case in practice has been reported where an integrity authority successfully obtained support from a tax authority for random verification of an asset declaration.

3.2.3 Money laundering

Various international treaties cover money laundering, such as the “Council of Europe Convention on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime and on the Financing of Terrorism” (CETS 198). To apply such treaties, one needs a suspicion of “money laundering”. During a general check of asset declarations, there is no suspicion yet: The purpose of the check is to ensure general compliance.

3.2.4 UNCAC

The United Nations Convention against Corruption is hailed as “the only legally binding universal anti-corruption instrument”.[6] While no one disputes the ground-breaking nature and impact of the UNCAC, its “several weak areas”[7] are common knowledge. One weak area is the lack of a mechanism for data exchange in purely administrative cases. The only provision in this regard is Article 43 para. 1: “Where appropriate and consistent with their domestic legal system, States Parties shall consider assisting each other in investigations of and proceedings in civil and administrative matters relating to corruption.” This provision is non-binding and much too vague to serve as a legal basis for cross-border data transfer under any standard of data protection.

3.3 Memoranda of Understanding

Memoranda of understanding are in itself not a sufficient legal basis for international data transfer, unless they are based on both sides on concrete legislative authorizations. Such legislative authorizations do not exist (see above 3.1); correspondingly, there are no memoranda of understanding on international data transfer for the verification of asset declarations.

A memorandum of understanding is “a document that describes the general principles of an agreement between parties, but does not amount to a substantive contract”.[8] Memoranda of understanding are non-binding, less formal, and more flexible than conventions or executive agreements. They do not require ratification.

MOUs are widely used in fighting money laundering: “FIUs share information between themselves informally in the context of investigations, usually based on memoranda of understanding (MOU).”[9] In the area of anti-money laundering, this works for the following reason: The laws establishing FIUs regulate data exchange with other FIUs and foresee the conclusion of MOUs for this specific purpose – FIUs are mainly established to exchange data internationally.

None of this is true in the area of asset declarations. Integrity bodies that are set up to verify asset declarations are not established with the primary purpose of exchanging data internationally; their statutory basis usually foresees no provision on international data exchange, even if (in some rare cases) it is either vague or does not match legislation of any other country or both; there are no international standards or platforms for the exchange of data for verifying asset declarations. Waiting for unilateral legislation in more than 160 countries to change by itself and hoping it would match the legislation of counterparts to allow for international data exchange would be unrealistic and naïve.

An international treaty, by contrast, provides a uniform, detailed standard on how data can be exchanged and its ratification creates the necessary statutory basis for data exchange.

4. Solution: an international treaty

Several countries could no longer bear the legal gap and international inaction. They drafted the “International Treaty on Exchange of Data for the Verification of Asset Declarations”;[10] four signed the Treaty between 2021 and 2023, and more are planning to do so. After ratification of at least three signatures, the Treaty will enter into force (probably in 2024).

4.1 How it works

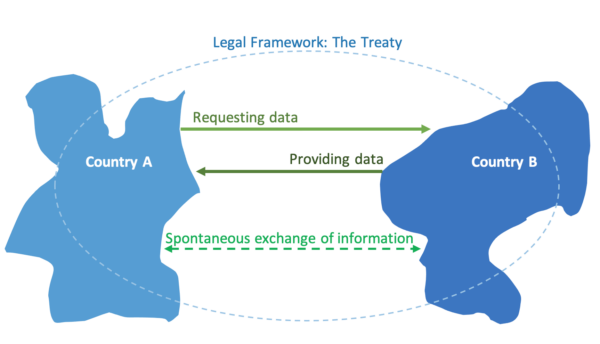

The Treaty copies the best practice of the international “Convention on Mutual Administrative Assistance in Tax Matters”, developed jointly by the Council of Europe and the OECD in 1988, and having 125 members as of today. The starting point is the disclosure of assets by public officials, an integrity mechanism that exists in most countries of the world. National legislation requires public officials to declare all their domestic and foreign income and assets. If asset declarations are verified effectively, among other things, they help to prevent financial and other private interests from interfering with public officials’ duties.

The basic rule established by the Treaty is that integrity bodies of two member states may exchange data if the data is needed in one country for verifying an asset declaration:

Any country in this world can join the Treaty. This is done in line with international practice by ratification or accession.

4.2 International support

During the consultation process in preparation for the UN General Assembly Special Session against Corruption 2021, the UNCAC Coalition recommended the International Treaty on Exchange of Data for the Verification of Asset Declarations as an example of good practice and called on Member States of the UNCAC to “address one of the top challenges in verifying asset declarations, […] [to] engage in discussions on creating a framework for the international exchange of this information.”[11]

At the Summit for Democracy 2021, Transparency International described asset declarations as “a powerful tool [..], especially when combined with […] country adherence to the International Treaty on Exchange of Data for the Verification of Asset Declarations”.[12]

The UNODC “Global Expert Group Meeting on Corruption involving Vast Quantities of Assets” reached the following Recommendation 2 in 2019 on “asset disclosure and verification: […] “International cooperation for asset verification should be strengthened, such as by exploring the possibility of entering into bilateral, regional or multilateral arrangements or instruments.”[13]

4.3 Accession by EU

Six years ago, heads from EU Member States encouraged “Western Balkans Governments […] to endorse and adopt [the] Regional Anti-Corruption Initiative’s International Treaty on Data Exchange on Asset Disclosure and Conflict of Interest”.[14] Four countries have signed the Treaty until October 2023.[15] It is now time for the EU to do its part: The European Union has a privileged status and can join the Treaty as a block. This will facilitate data exchange with 27 countries in one simple step, including many essential destinations for hiding assets.

5. What civil society organisations can do

The effect of data exchange mechanisms greatly depends on the number of participating countries. The more countries join members of the Treaty, the more comprehensive the available information and the more effective the verification of asset declarations. At the moment, many asset declaration oversight bodies and governments worldwide might not know about the Treaty. Civil society organisations can raise awareness of the Treaty and advocate with legislators for accession to the Treaty. When being consulted by international monitoring bodies, such as UNCAC Peer Reviews or GRECO, they can remind evaluators that access to foreign data is lacking. They can encourage international organisations to take on advancing the Treaty on their political agenda. Concerning the accession of the European Union to the Treaty, they can advocate Member States and the European Commission to speed up the EU’s joining of the Treaty.

Dr. Tilman Hoppe is an anti-corruption expert based in Berlin, who advised international vetting in Moldova and Ukraine. He is a former co-chair of the selection commission for the head of the anti-corruption agency in Ukraine (NACP). For more information, please contact the author at email hidden; JavaScript is required.

[1] World Bank, Enhancing Government Effectiveness and Transparency: The Fight Against Corruption, 2020, Chapter 8, https://pubdocs.worldbank.org/en/419301611672162231/Asset-and-Interest-Declarations.pdf.

[2] G.S.B. v. Switzerland, Application no. 28601/11, Judgment of 22 December 2015, § 68, https://hudoc.echr.coe.int/eng?i=001-159732.

[3] G.S.B. v. Switzerland, Application no. 28601/11, Judgment of 22 December 2015, § 73, https://hudoc.echr.coe.int/eng?i=001-159732.

[4] See, e.g., the European Convention on Mutual Assistance in Criminal Matters (ETS 30).

[5] See, e.g., the OECD Convention on Mutual Administrative Assistance in Tax Matters (ETS 127).

[6] https://www.unodc.org/unodc/de/treaties/CAC/.

[7] U4 Brief 2010:6, p. 3, https://www.cmi.no/publications/file/3769-uncac-in-a-nutshell.pdf.

[8] https://www.collinsdictionary.com/de/worterbuch/englisch/memorandum-of-understanding.

[9] Bank for International Settlements, Summary of a meeting of representatives of Supervisors and Legal Experts of G10 Central Banks and Supervisory Authorities on 14 December 2001, Basel, Switzerland, https://www.bis.org/publ/bcbs89.htm.

[10] https://rai-see.org/what-we-do/regional-data-exchange-on-asset-disclosure-and-conflict-of-interest/.

[11] UNCAC Coalition, Contribution to the Consultation Process in Preparation of the UN General Assembly Special Session against Corruption 2021, Submission 2, Key topics for the UNGASS, March 2021, p. 15 and 17, https://uncaccoalition.org/wp-content/uploads/UNCAC-Coalition-%E2%80%93-2nd-UNGASS-submission_March-20201.pdf.

[12] Transparency International, Addressing corruption as a driver of democratic decline, Positions towards Summit for Democracy 2021, p. 13, https://images.transparencycdn.org/images/2021-Addressing-corruption-as-driver-of-democratic-decline-Summit-for-Democracy-PositionPaper-EN.pdf.

[13] UNODC, Oslo Statement on Corruption involving Vast Quantities of Assets 14 June 2019, p. 2, https://www.unodc.org/documents/corruption/meetings/OsloEGM2019/Oslo_Outcome_Statement_on_Corruption_involving_Vast_Quantities_of_Assets_-_FINAL_VERSION.pdf.

[14] Trieste Western Balkan Summit, Joint Declaration Against Corruption, 12 July 2017, https://www.esteri.it/it/sala_stampa/archivionotizie/approfondimenti/2017/07/trieste-western-balkan-summit-joint/.

[15] https://rai-see.org/what-we-do/regional-data-exchange-on-asset-disclosure-and-conflict-of-interest/.