15 December 2016, by Michael Kavanagh, Thomas Wilson, and Franz Wild, Bloomberg.

This post was originally published on the Bloomberg website.

Boys mine for copper in a pit about 20 kilometers (12.4 miles) outside Lubumbashi, Democratic Republic of Congo. / Photographer: Per-Anders Pettersson/Getty Images

Joseph Kabila and his relatives have built a network of businesses that reaches into every corner of Congo’s economy. Is that why he won’t step down?

In his only public speech this year, Joseph Kabila, president of the Democratic Republic of Congo, was defiant about his refusal to hand over power when his final term ends on Dec. 19. “I cannot allow the republic to be taken hostage by a fringe of the political class,” he told parliament last month as members cheered.

His presidency had brought peace and economic growth to Congo, the 45-year-old said, outlining reforms he’d made in telecommunications, mining, energy and banking. What he didn’t say is how some of his own family members are among the biggest beneficiaries of those changes—including his sister Jaynet and brother Zoe, who both listened from the front row as elected members of parliament.

Together the Kabilas have built a network of businesses that reaches into every corner of Congo’s economy and has brought hundreds of millions of dollars to the family, a Bloomberg News investigation has found. The sprawling network may help explain why the president is ignoring pleas by the U.S., the European Union and a majority of the Congolese people to hand over power next week, though his advisers dispute this.

Kabila at parliament for his only public speech of the year on Nov. 15, 2016, in Kinshasa. / Photographer: Junior D. Kannah/AFP via Getty Images

Kabila’s refusal to step down threatens to thrust his country back into the kind of chaos that cost millions of lives after his father took power nearly two decades ago. It could also destroy the tenuous stability that attracted international investment—mainly from mining giants like Freeport-McMoRan Inc. and Glencore Plc—and turned Congo into Africa’s biggest producer of copper, tin and cobalt.

In February, S&P Global Ratings lowered Congo’s investment outlook to negative amid rising political tensions. It affirmed that view in August. The last civil war destroyed the country’s copper industry, cutting production more than 96 percent by the time the conflict ended in 2003.

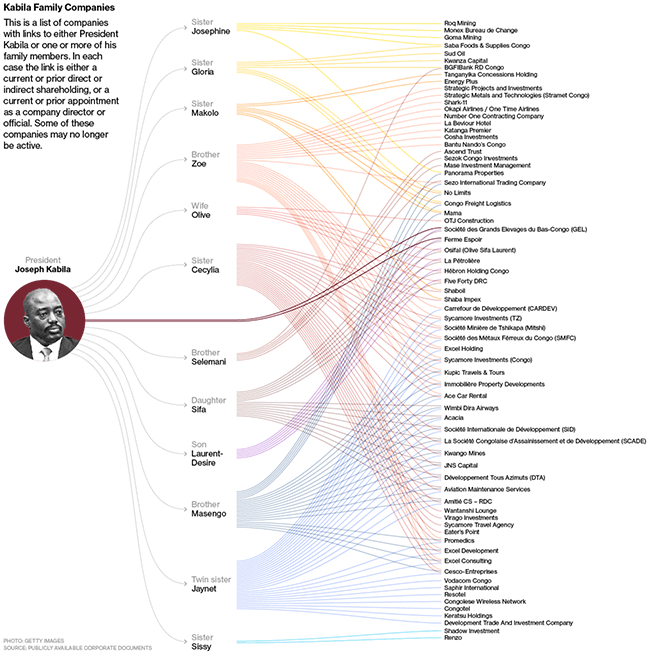

Since then, foreign investment has helped generate more than 100,000 jobs in mining and oil alone, tripled the size of the economy—and allowed the family’s empire to flourish. Over that period, Kabila and his siblings have assembled an international business network stretching across at least 70 companies, according to a Bloomberg News analysis of thousands of company documents and court filings as well as dozens of interviews with bankers, businessmen, miners, farmers and former government officials.

While Congolese law doesn’t prohibit politicians or their families from having business interests, the scope of that empire has only recently become visible, in publicly available corporate and government records that Congolese regulators have computerized and made searchable in just the past few years. Bloomberg News, with support from the Pulitzer Center on Crisis Reporting, traced the Kabilas’ interests by amassing an archive of hundreds of thousands of pages of corporate documents that shows his wife, two children and eight of his siblings control more than 120 permits to dig gold, diamonds, copper, cobalt and other minerals.

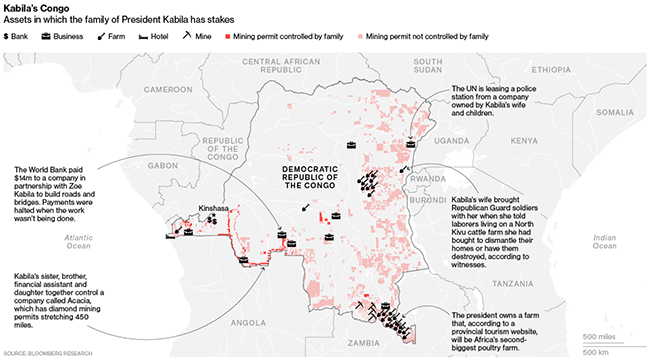

Two of the family’s businesses alone own diamond permits that stretch more than 450 miles across Congo’s southwestern border with Angola. Family members also have stakes in banks, farms, fuel distributors, airline operators, a road builder, hotels, a pharmaceutical supplier, travel agencies, boutiques and nightclubs. Another venture even tried to launch a rat into space on a rocket.

In Congo’s largely informal, cash-based economy where the family stakes are almost all in privately held companies, the exact value of the businesses isn’t known. The few figures available in publicly accessible documents show investments worth more than $30 million in just two companies. Estimated revenue for another company exceeds $350 million over four years—in a country where World Bank data show that nearly two-thirds of the 77 million people live on less than $1.90 per day.

While some of the businesses are owned directly, the family also has dozens of joint ventures and shell corporations through which it holds stakes to varying degrees in all manner of industries. That creates a system so pervasive that even seemingly innocuous payments—such as rent paid by the UN for a police station—end up finding their way to the Kabila family, an analysis of the network shows. It can be a ham-handed operation: Perhaps in its eagerness to tap the country’s resource wealth, the family has sometimes driven away outside investment that would have made some of its members even more money.

Government spokesman Lambert Mende said he couldn’t comment on issues concerning the president’s family, which he considered a private matter. When asked how Bloomberg News could direct questions to Kabila, he said the president does not talk to Western media. Theodore Mugalu, who handles the family’s personal affairs, didn’t respond to a series of phone calls and text messages requesting comment.

Kabila’s second term as president ends on Dec. 19, and the constitution bars him from running again. But the country’s electoral commission has delayed elections until at least April 2018, and a constitutional court that Kabila created last year has ruled he should stay on until a vote is held.

Publicly, Kabila says the delay has nothing to do with him and that an election will be called once voter-registration rolls are complete. Privately, he tells associates he’s staying put, says Francis Kalombo, one of his closest allies until he broke ranks last year. “He’s not going to do all that he’s doing, make all this effort, for one more year,” Kalombo said. “For him, it’s for life.”

Kabila’s chief diplomatic adviser, Barnabe Kikaya Bin Karubi, called the accusation false. “To say that he wants to stay in power because he wants to protect all these business deals, I think, is not proper,” Kikaya said in an interview in Paris. “He has said time and again what he wants to leave as a legacy to the Congo: a democratic process.”

Kikaya, who said he couldn’t comment on behalf of the president about his family’s affairs, nevertheless defended their right to conduct business. “The Congo is their country—they have to live, they have to have an income,” he said. “Whether their position as the first family makes things easy for them I think is normal. It’s normal, provided no laws are broken.”

For most Congolese, the economy isn’t booming anymore. The government has had to revise down its growth forecast three times this year due to weak commodity prices. It’s now at 4.3 percent from an initial goal of 9 percent in the 2016 budget.

Flares launched by police forces during a demonstration in Goma on Sept. 19, 2016. More than 40 people were killed in the Democratic Republic of Congo when clashes erupted ahead of a planned opposition rally. / Photographer: Mustafa Mulopwe/AFP via Getty Images

In September, Kabila’s security forces shot, hacked and burned pro-democracy protesters in Kinshasa, the capital, killing more than 40, a UN investigation into the events found. They poured gasoline onto the headquarters of the main opposition party, set it alight and threw fleeing civilians into the flames, the UN said.

On Dec. 12, the U.S. sanctioned Congo’s interior minister and its national intelligence agency administrator, saying that the Congolese government was undermining democratic processes and putting the long-term stability and prosperity of the country at risk. On the same day, the European Union imposed sanctions on seven police and military officials for their role in September’s violence and for “allegedly trying to obstruct a peaceful and consensual solution to the crisis in the DRC.”

Further violence and unrest could spill over Congo’s nine borders, drawing in neighboring countries as it did in wars between 1996 and 2003. And it would squander the $40 billion that international donors, led by the U.S., have spent in Congo in the last 16 years, mostly on a UN mission, humanitarian and development assistance, and debt relief.

“We’re heading for a big, slow-motion crisis,” said Jean-Marie Guehenno, head of the International Crisis Group think tank, who knows Kabila from his eight years as the UN’s head of peacekeeping. “Why is he refusing to go? For the sake of power? To protect the family business? Probably a bit of both.”

Joseph Kabila grew up with his siblings in exile in Tanzania, the children of Laurent-Desire Kabila. Their childhood was modest but full of intrigue, as their heavyset, charismatic rebel father moved from country to country using fake passports and trying to gin up support for his fight against the U.S.-backed dictator Mobutu Sese Seko.

Laurent-Desire fathered at least 25 children with seven different women, according to a biography published by Belgian researcher Erik Kennes in 2003. Joseph, Jaynet and younger sister Sissy were born in Congo; Zoe, sisters Cecylia and Josephine in Tanzania; and younger brother Masengo and sister Gloria in Uganda, according to their declarations in corporate filings. Another brother, Francis Selemani Mtwale, was adopted as a child.

After their father became president in 1997 by overthrowing Mobutu with the help of a coalition of African governments, he immediately set about making money for his government—and for family and friends, according to Kennes’s biography.

The places he’d fought in the bush as a young rebel became the names of commercial interests. Hewa Bora, the rebel base where his twins Jaynet and Joseph were born, became an airline, a fuel station, a farm and a mining site. Wimbi Dira, another rear base, gave its name to a second airline.

But Laurent-Desire’s shakeup of the old economic and political order made enemies, and in 2001 he was assassinated by his own bodyguard. Within weeks, Joseph, Congo’s army chief at the time, was chosen as his successor. He was only 29.

A Republican Guard soldier patrols the streets of Kinshasa, Democratic Republic of Congo. / Photographer: Junior D. Kannah/AFP via Getty Images

Since then, the Kabila family’s businesses have grown with Congo’s developing economy. And they now enjoy a perk of presidential power: the protection of the Republican Guard, an elite army unit that is supposed to protect Kabila himself. In July 2015, guard members accompanied his wife, Olive, after she had bought a cattle farm in the grassy hills of North Kivu. According to three laborers who were displaced, she demanded they remove their makeshift homes or watch soldiers destroy them. Olive didn’t respond to multiple phone calls and text messages sent to her assistant.

Many of the companies are run by Jaynet, Joseph Kabila’s twin sister. After their father’s death, documents show, she set up companies across Congo, as well as in the U.S., Panama, Tanzania and on the South Pacific island of Niue. Company filings show she is or has been a shareholder or director in at least 28 companies. In some, she controlled a majority of shares while in others she held minority stakes, the filings show. It’s unclear how many of those companies are still active.

The lack of transparency in some of the family’s dealings has hurt Congo’s economy. In 2012, the International Monetary Fund cut its half-billion dollar loan program with Congo after the government declined to publish contracts related to a 2011 deal for a copper mine known as Comide. One of the companies involved in the deal, Goma Mining, was at least 10 percent owned by the family and chaired by Kabila’s sister, Josephine, according to court records from 2013.

The family’s involvement in mining—diamonds, cobalt and copper—comes in part through a company called Acacia, which was majority-owned by Jaynet; younger brother Masengo; Joseph Kabila’s 16-year-old daughter, Sifa; and his financial assistant, Emmanuel Adrupiako, based on corporate records from September 2014.

In the remote southern town of Tembo, people haven’t heard of Acacia or another family-controlled company called Kwango Mines that together hold 96 mining permits. But they seem to know who controls the diamonds in the river. “All the documents for this project are now in the hands of Jaynet Kabila, the twin sister,” said diamond trader Jauvin Manzaza, pointing to the wide Kwango River that tracks the border with Angola.

Kabila-controlled companies first arrived here in 1998, Manzaza said, armed with tractors and machinery to dig for diamonds 15 miles south of the town. In 2003, a company controlled by Selemani and Kabila’s younger brothers Zoe and Masengo sold more than $12 million of gems, export data show. Diamonds accounted for three-quarters of Congo’s export revenue that year, which also marked the end of the country’s civil war, attracting international diamond companies.

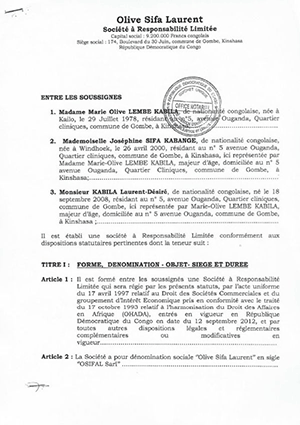

Once there, those firms found they had no choice but to negotiate with the Kabila clan, said Mike De Wit, head of exploration in Congo from 2003 to 2007 for the world’s largest diamond producer, De Beers. In 2006, De Beers signed an agreement to explore with permits belonging to a company controlled by Olive Lembe, a few months before she married the new president, De Wit said. That company is now called Olive Sifa Laurent, or Osifal for short, named after its shareholders: Olive, the couple’s daughter, Sifa, and 8-year-old son, Laurent-Desire.

Incorporation documents for a company known as Osifal, owned by Kabila’s wife and their two children. It has had interests from fuel to mining.

“When Kabila came to power, he looked like an honest guy and business was actually doable, so that’s why De Beers went into there,” De Wit said in an interview. “With time, it became obvious that that wasn’t the case.“

De Beers confirmed the arrangement with Osifal in an e-mail, adding that it was terminated in 2008 because “there was no potential.” De Beers left Congo entirely in 2009 after it “concluded that the business operating environment was not one in which De Beers would be comfortable to operate in.”

Later, as the head of exploration for Toronto-listed Delrand Resources Ltd. (then known as BRC Diamond Core), De Wit had to negotiate with the family again. BRC had an option to pay approximately $350,000 for 55 percent of the rights to develop six Acacia licenses along the Kwango River and farther west. Then, according to De Wit, Jaynet decided to renegotiate.

“In one meeting they said, ‘Maybe we want $2 million’ and in the following meeting said, ‘Well, actually it’s worth $10 million,’ ” De Wit said of the negotiations.

Jaynet made it clear that she set the rules in Congo and wanted a contract where she was earning “big dollars,” De Wit recalled. “It was never enough,” he said. Delrand walked away from the agreement in 2014, recording a $3.1 million loss over the project.

Jaynet didn’t respond to multiple telephone calls and text messages requesting a response. Delrand Chief Executive Arnold Kondrat didn’t reply to voicemail messages requesting comment.

Adrupriako, Kabila’s financial assistant, said in a telephone interview that Acacia couldn’t agree with Delrand over the ownership of the mining venture, and the project was abandoned. He said he hasn’t been involved with Acacia since 2005.

Today near Tembo, hulking machinery rusts in the tropical heat. Without major mining company investment, artisanal miners instead dig in the riverbed in search of diamonds.

“We stopped working the concession but we still control it,” said Major Freddy Kakudji, the ranking officer in the small group of Republican Guard soldiers left behind to patrol the river.

Men dive for diamonds in the Kwango River, south of Tembo, Democratic Republic of Congo, on Oct. 29, 2016. / Photographer: Thomas Wilson

Thirty miles to the south, men in restitched wetsuits dive for diamonds off the edge of a flotilla of 20 multicolored dinghies, scraping gravel from the riverbed. When Republican Guard soldiers come by, the divers hand over buckets of potentially gem-filled gravel as an informal tax.

It’s unclear how much revenue diamonds generate for Kabila family businesses today. Congo’s diamond production has halved since 2005, overtaken by copper, cobalt and gold.

To read the rest of this article, please go to this link: https://www.bloomberg.com/news/features/2016-12-15/with-his-family-fortune-at-stake-congo-president-kabila-digs-in